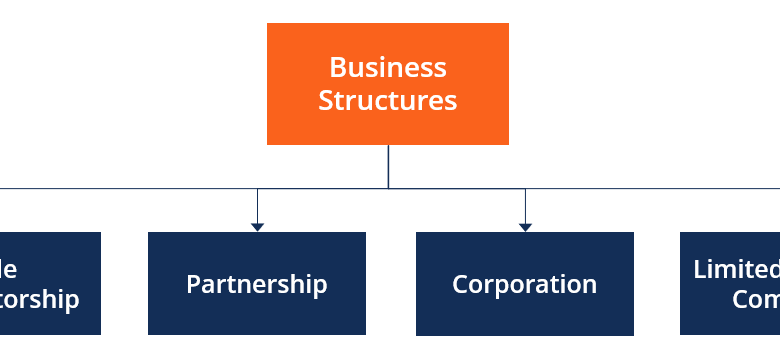

Understanding the Different Types of Company Structures in New Jersey

- Sole proprietorship

According to the U.S. Small Business Administration, the most basic and popular business entity structure for starting a business in New Jersey is a sole proprietorship. It is an unincorporated company owned by a single person without distinguishing between the two entities. Your company’s debts, losses, and liabilities are your responsibility, and you can keep all profits.

A sole proprietorship is the best option for someone looking to launch a one-person company fast with limited funds. The owner has limited liability protection and won’t be looking for outside investment.

A sole proprietorship has minimal initial expenses, absence of organizational paperwork, no legal charges for document preparation, and no filing fees.

If the business is operating under a name other than the owner’s, no formation paperwork needs to be submitted to government agencies (apart from a “Doing Business As” (DBA) certificate). One tax benefit for small business owners is that they only pay once. Since the owner and the business do not pay income taxes separately, the owner’s personal tax returns can handle all income tax payments. In a sole proprietorship, the owner is responsible for all business-related expenses, including debts and liabilities. The company closes down when the owner dies or becomes incapable of operating.

- General partnership

In New Jersey business registration, creating a partnership agreement or registering as one with the government is unnecessary. You are in a partnership when you and another individual decide to work together on a project for profit, either orally or in writing. If necessary, you must obtain a business license and register a DBA.

All income received as a partnership will be taxed as regular income and pass through to the partners. Additionally, any debts or judgments of the partnership, including those against your partners, may subject you personally as a partner.

- The Limited Liability Company

The Limited Liability Company, or LLC, is a hybrid business structure that offers many of the advantages of a corporation with less tax or reporting burden. There aren’t many other annual requirements for LLCs other than filing Articles of Organization. An LLC is typically created to shield the owner from personal debt related to the company’s obligations. Usually, neither the members nor the LLC are responsible for the debts and liabilities of the business.

- Corporations

A corporation is a separate legal entity established by state law with a distinct legal existence. A C corporation and a S corporation are the two different types of corporations. The most popular and advantageous form of corporation is the C corporation. A C corporation, however, is vulnerable to double taxation. This implies that each shareholder is taxed on any dividends paid to them, in addition to the corporation being taxed on its profits.

A corporation that establishes itself as a separate legal entity with an existence apart from its owners is known as an S corporation. This kind of organization is pass-through and is not subject to double taxation, in contrast to a C corporation.

C corporation provides Specialized management, Ownership is transferable, Continuous Existence and it is easier to raise capital. It is strictly regulated. Corporations must maintain separate books, records, and accounts, hold annual meetings, and comply with onerous formalities and filings mandated by state law. A C corporation’s greatest drawback is that it is not a pass-through entity subject to double taxation, and any losses do not trickle down to its shareholders unless it is set up as a S corporation.