Reducing Financial Service Costs and Boosting Marketing Effectiveness with Digital Transformation

In Today’s changing world financial landscape is also changing, and some sector faces immense pressure to meet the demands of their customers. Digital Transformation in BFSI is essential for cost reduction and market improvement. With digital solutions work in financial institutions has become smoother, and customer experience has been enhanced.

Why is Digital Transformation Important In BFSI?

Digital Transformation in BFSI is important because it meets regulatory requirements and ensures customer satisfaction. There were many challenges in traditional banking methods which were slow and expensive, making customers unhappy. Using technologies like artificial intelligence, machine learning, and data analytics, improved services. It is an important part of digital transformation to adopt digital customer experience solutions. It helps financial institutions with a smooth and personalized experience for their customers.

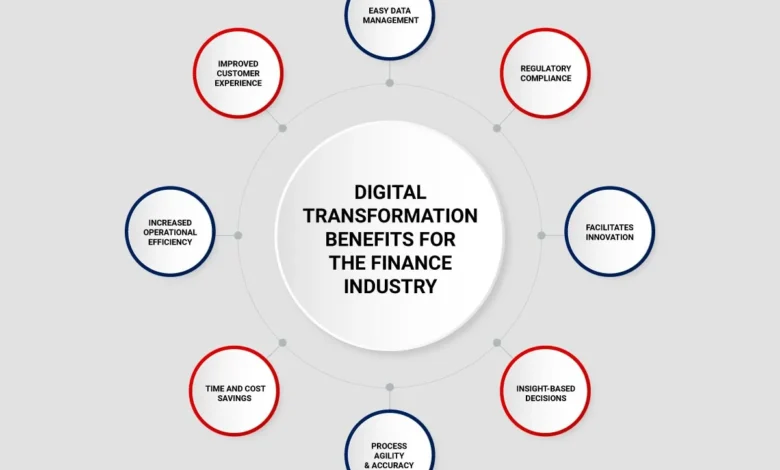

Benefits of Digital Customer Experience Solutions

The pioneering identity for using technical platforms was necessary to intensify how companies in the financial sector address their consumers. There are many ways of improving the clarity of communication and effectiveness of the business transactions with the customers. Some key benefits are:

Personalized Services: This is possible by integrating Data Analytics and Machine learning that will help those financial institutions understand customer needs and satisfaction to get them the right satisfactory and value-for-money products and services.

Improved Efficiency: The involvement of business process automation in the business process and structure reduces the amount of time and effort that must be dedicated to the accomplishment of tasks and enhancement of processes; thus, the business operating costs are reduced, and high speed and accurate provision of the services and products are achieved

Enhanced Security: Digital services need to continue to implement greater security measures and other aspects of the service, such as biometric identification and cryptocurrency systems to ensure the customer’s data is protected and there is no occurrence of such schemes.

24/7 Accessibility: Such options afford consumers the chance to acquire banking services at their preferred time and place; this is because the need to access information within the sector at any given time has been easily addressed.

How Digital CX Solutions Improve Marketing?

Creating improvement in efficiency and customer experience, the digital transformation in the BFSI context improves marketing performance. Thus, by using customer experience solutions, one can develop an ideal marketing strategy and publicity campaign for financial institutions desiring to have an improved conversion ratio as well as better game returns or (ROI).

Data-Driven Marketing: Therefore, by evaluating data & information, which is gathered from various sources, proper marketing strategies can emerge targeted towards their customers.

Omni-Channel Engagement: Digital CX solutions are defined as the capacity and strategy of organizations to sustain an appropriate and efficient dialogue along the touch points including consumer touch points of social media, email, mobile application, and website.

Real-Time Feedback: Customers being reached through social media marketing can be involved in the marketing processes in real-time, particularly by offering feedback that may assist fix any strategy affiliated with financial institutions’ marketing.

Cost Efficiency: There is one more important point to mention, despite the fact that digital campaigns will cost less than traditional ones. These approaches should be tracked and measured to look for the ROI and overall results, and banks should then use proper automated solutions and analytic tools to assess the return on investment in each method to improve outcomes.

There has been an arising of various opportunities in marketing automation and several other relevant digital practices that the BFSI sector can harness to get better or bigger quantity and quality. It has been repeatedly mentioned that implementing new digital customer experience solutions can bring benefits to financial institutions: ways in which the overall satisfaction level of the customers can be enhanced, how we can work better, and achieve a more competitive edge. Overall, this means that by engaging Digital CX Solutions it is possible to maintain the operations and reach the correct client several times to get the accurate marketing needed for the growth and profitability of the business.

The idea of continuity and creation is what would define the future of the BFSI industry. In this regard, the effectiveness of employing digital solutions in the FDs can be defined as one that makes these financial institutions able to respond and cater to the needs of their customers more than any other financial institution.