How FintechZoom SP500 Can Help You Navigate And Invest In The S&P 500?

Are you looking to elevate your investment strategy in the S&P 500 and make smarter financial decisions? With the ever-changing landscape of the financial market, staying ahead of the curve can be challenging. That’s where Fintechzoom SP500 comes in—a powerful tool designed to help you make well-informed investment choices. By integrating advanced technology and insights from experienced financial experts, this platform offers a fresh approach to understanding and analyzing the S&P 500.

Fintechzoom SP500 is more than just a data-driven tool; it’s a comprehensive resource that combines essential factors such as market spreads, algorithms, correlations, and expert judgment. These elements work together to provide a clear, centralized analysis of the market, allowing you to track trends, opportunities, and potential risks with ease. Whether you’re a seasoned investor or just beginning your journey, this platform makes complex data accessible and actionable, so you can confidently navigate the financial markets.

The user-friendly design of Fintechzoom SP500 ensures that you’re able to focus on what truly matters—making strategic investment decisions. It’s a resource that simplifies market analysis, empowering you with the insights needed to make timely and profitable choices in the S&P 500. With Fintechzoom SP500, you gain the tools and confidence to take your investment strategy to the next level, unlocking new opportunities for financial growth.

What Is The S&P 500?

The S&P 500 is one of the most influential stock market indexes in the world. It serves as a key barometer for the performance of the U.S. stock market, providing valuable insights into the overall health of the economy. The index tracks the stock prices of 500 of the largest publicly traded companies in the United States, spanning a wide range of industries including technology, healthcare, finance, and consumer products. By covering such diverse sectors, the S&P 500 offers a comprehensive view of the market’s performance.

Companies included in the S&P 500 are selected based on factors like market capitalization, trading volume, and overall financial stability. These carefully chosen criteria help ensure that the index accurately represents the U.S. stock market and its largest players. Created by Standard & Poor’s, the S&P 500 has become a trusted and widely followed benchmark for investors, analysts, and policymakers alike. Its movements provide essential data for understanding market sentiment, identifying emerging trends, and making informed investment decisions.

For anyone navigating the complexities of the financial world, understanding the S&P 500 is essential. It not only reflects the performance of top companies but also offers valuable insights into broader economic conditions, making it an indispensable tool for anyone looking to make smarter, more informed financial choices.

Historical Returns And Economic Ups And Downs Of The S&P 500

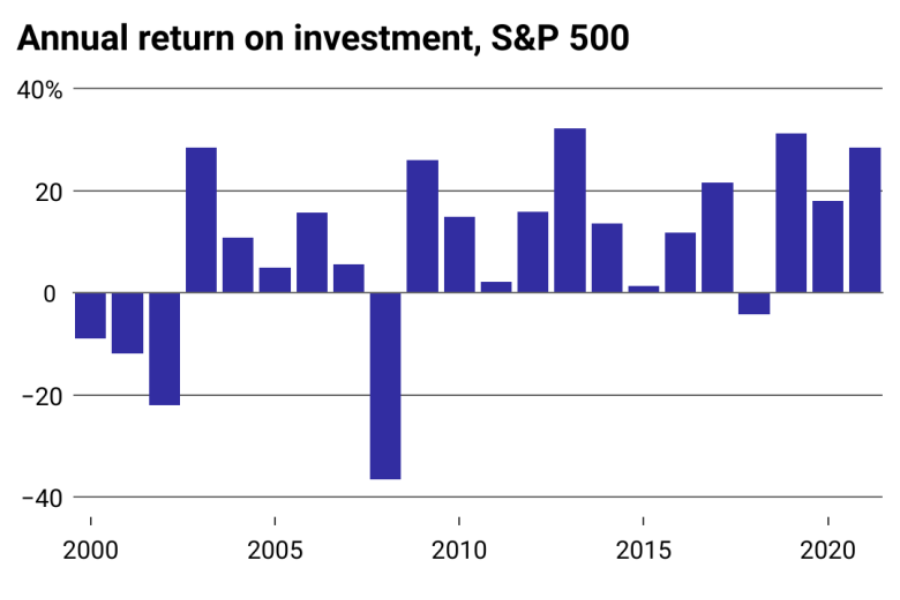

Since its inception, the S&P 500 has experienced both remarkable growth and significant downturns. The index’s average annualized return from 1957 to the end of 2023 was 10.26%, reflecting the resilience and long-term success of the companies within it.

Some notable annual returns include:

- 2023: 26.29%

- 2022: -18.11%

- 2021: 21.83%

- 2020: 18.40%

- 1992–2024: 10.94%

The history of the S&P 500 is marked by periods of economic highs and lows, from market booms to recessions. It has weathered countless economic challenges, including technological revolutions, geopolitical events, and market crashes. Despite these obstacles, the companies within the S&P 500 have consistently shown resilience, delivering long-term positive returns and proving their strength in the face of adversity. This historical track record has cemented the S&P 500’s place as a reliable indicator of the health and performance of the U.S. economy.

Key Features Of Fintechzoom SP500: Essential Tools For Investors

| Feature | Description |

|---|---|

| Real-Time Market Data | Provides users with up-to-date market data, ensuring decisions are based on the most recent information. This feature helps investors respond to market shifts quickly and effectively. |

| Customizable Dashboards | Allows users to adjust the layout and focus of the platform to suit their needs. This customization ensures that investors can prioritize the most relevant data, leading to clearer and more focused decision-making. |

Fintechzoom SP500 offers a range of features designed to enhance the investment experience for users. One of the key features is the real-time market data, which keeps investors informed with the latest market trends. By working with current data, investors are able to make well-timed decisions that align with the ever-changing market conditions. Another valuable feature is the customizable dashboard, which allows users to personalize the platform to highlight the information most important to them. This customization helps investors stay focused on the metrics that matter most, making the decision-making process more efficient and effective.

The Relationship Between The S&P 500 And Fintechzoom

Fintechzoom plays a crucial role in providing in-depth analysis and real-time updates on the S&P 500 index. As an insightful platform for investors, it offers a wide range of tools to track the latest market movements, trends, and key breakthroughs related to the S&P 500. By delivering easy-to-understand statistics and up-to-date data, Fintechzoom helps users navigate the complexities of the stock market with greater clarity. This makes it an invaluable resource for those looking to stay informed about the performance of the S&P 500 and its impact on the broader market.

In addition to offering specialized insights into the S&P 500, Fintechzoom serves as a comprehensive platform for market analysis. Whether you are a seasoned investor or a newcomer to the world of finance, the platform provides the tools necessary to analyze market patterns and make well-informed decisions. While its focus on the S&P 500 is a key feature, Fintechzoom also supports a wider range of financial markets, allowing users to broaden their research and gain insights into other indexes and investment opportunities. This dual approach helps investors make smarter choices by offering both specialized and generalized market analysis.

How Fintechzoom Enhances S&P 500 Investment Strategies?

1. Data-Driven Decision-Making

Fintechzoom provides access to a variety of data analysis tools that allow investors to make informed decisions. These tools offer detailed insights into past performance, real-time updates, and market trends within the S&P 500. By analyzing historical data and identifying emerging patterns, investors can uncover opportunities that might not be immediately apparent using traditional methods of analysis. This data-driven approach empowers investors to make more strategic choices and stay ahead of market changes.

2. Diversification Strategies

One of the key strengths of Fintechzoom is its ability to assist investors with diversification strategies. By focusing on emerging sectors and industries within the S&P 500 that show signs of growth, Fintechzoom helps investors spread their investments across various market segments. This diversification reduces concentration risk and improves portfolio performance by allowing investors to invest in a balanced mix of industries that are well-positioned for future growth.

3. Educational Resources

Fintechzoom offers a wealth of educational resources, including articles, tutorials, and webinars. These resources are designed to help both novice and experienced investors gain a deeper understanding of the S&P 500 index and the broader financial markets. By providing valuable knowledge, Fintechzoom enables investors to make better-informed decisions, build confidence in their investment strategies, and navigate the complexities of market fluctuations with greater ease.

4. Customization Options

To further enhance the user experience, Fintechzoom offers a range of customization options. Investors can tailor their platform experience based on their individual investment goals, preferences, and risk profiles. Features like personalized alerts, portfolio trackers, and customized investment suggestions help users stay on top of their financial goals and adjust their strategies in response to changing market conditions. Whether you’re focused on long-term growth or short-term gains, Fintechzoom makes it easier to align your investments with your objectives.

A Comparison Between The S&P 500 And Dow Jones: Understanding The Key Differences

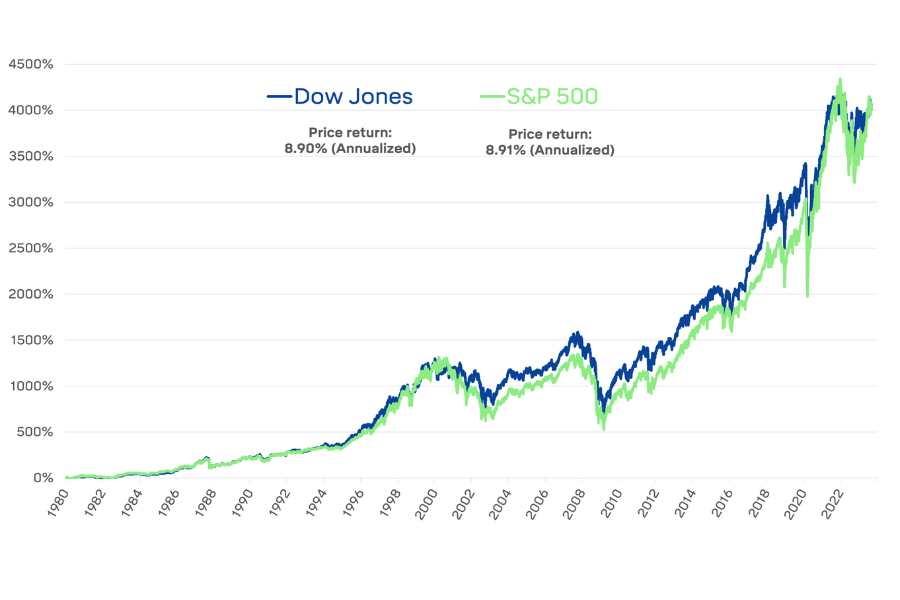

The Dow Jones Industrial Average (DJIA) and the S&P 500 are two major U.S. stock market indices, but they differ in composition, weighting methods, and performance tracking. Here’s a brief comparison of these key differences.

| Feature | Dow Jones (DJIA) | S&P 500 |

|---|---|---|

| Composition | The DJIA consists of 30 large-cap stocks from diverse sectors, chosen by the editors of The Wall Street Journal. These companies are typically industry leaders and are referred to as “blue-chip” stocks. | The S&P 500 includes 500 of the largest publicly traded companies in the U.S. and accounts for around 80% of the total U.S. stock market capitalization. It offers broader sector coverage. |

| Weighting Methodology | The DJIA is a price-weighted index, meaning that stocks with higher prices, regardless of their market capitalization, have more influence on the index’s movements. | The S&P 500 is market capitalization-weighted, where companies with larger market caps have a greater impact on the index. This makes it more representative of the broader market. |

| Performance Tracking | The DJIA is often seen as a benchmark for the performance of large, established corporations, mainly focusing on blue-chip stocks. | The S&P 500 provides a broader picture of the U.S. stock market’s overall performance, tracking both large-cap and mid-cap companies across multiple sectors. |

| Investment Strategies | Investors interested in the DJIA tend to focus on the performance of the 30 constituent companies, which are often viewed as stable and reliable, with many offering dividends. | Investors seeking more diversification may prefer the S&P 500, as it tracks a larger pool of companies and can be accessed through exchange-traded funds (ETFs) or mutual funds that mimic the index. |

Why Invest In The S&P 500?

The S&P 500 Index stands as one of the most reliable benchmarks for the performance of the U.S. stock market. Tracking the performance of 500 of the largest publicly traded companies in America, it spans a wide range of sectors including technology, healthcare, consumer goods, and more. Many investors gravitate toward the S&P 500 due to its historical track record of stability and strong returns, making it a go-to choice for those looking to invest in the broader market.

Comprising roughly 80% of the total U.S. stock market capitalization, the S&P 500 serves as a key indicator of the health of the U.S. economy. The companies within the index are generally considered leaders in their respective industries, with a proven history of financial stability. This makes the S&P 500 a less volatile investment compared to individual stocks, offering a reliable means for long-term growth.

Practical Impact And Success Stories

Transforming Investment Approaches with FintechZoom

The real-world impact of FintechZoom on investment strategies is demonstrated through the success stories of its users. One such case involves a novice investor who utilized FintechZoom’s trend analysis and risk assessment features to build a diversified portfolio centered around the S&P 500. Thanks to the platform’s easy-to-use interface and strategic guidance, the investor was able to exceed market returns within the first year, proving the platform’s ability to empower beginners to navigate complex financial markets effectively.

Another success comes from a seasoned investor who used FintechZoom’s real-time data and predictive tools to recalibrate their investment approach during a market downturn. By leveraging the platform’s portfolio management capabilities, this investor was able to mitigate risk and optimize performance during periods of high volatility. The combination of up-to-date market insights and advanced risk management features allowed them to maintain a balanced approach, further highlighting FintechZoom’s value for experienced investors looking to stay ahead of market trends.

Challenges And Considerations When Using FintechZoom For Investments

Identifying Potential Risks

Though FintechZoom offers robust investment tools, it’s crucial for investors to understand the potential risks involved. Relying on algorithms and automated systems can sometimes lead to unpredictable results. Market conditions can fluctuate quickly, and despite the platform’s advanced technology, it is not immune to sudden changes. Being mindful of these risks and making well-informed decisions is essential for managing potential losses.

Navigating the Learning Curve

For new users unfamiliar with fintech platforms, there may be some challenges in getting started. Understanding how to fully leverage the various features of FintechZoom might take some time. However, the platform offers a wealth of educational resources such as tutorials and customer support to assist users in navigating the system. With these tools, beginners can quickly familiarize themselves with the platform’s functionalities.

Comparing with Traditional Investment Services

FintechZoom stands out for its flexibility and lower costs compared to traditional brokerage services. However, traditional brokers often offer more personalized support, which some investors may still prefer. For those who value face-to-face interactions and tailored advice, the lack of personalized attention on FintechZoom might be a disadvantage. Yet, for investors seeking a more efficient, self-directed, and cost-effective investment experience, FintechZoom provides an attractive alternative.

The Future Of FintechZoom In The S&P 500 Landscape

Enhancements on the Horizon

FintechZoom is focused on enhancing its platform with new features and tools aimed at improving user experience. The company is developing updates that will allow investors to gain more comprehensive insights into market trends, making it easier to manage and understand investment portfolios. As these features roll out, users can expect a more intuitive and valuable investment journey.

The Growing Influence of Fintech in Investing

The rise of fintech platforms like FintechZoom is transforming the investment landscape by making financial technology more accessible and user-friendly. These platforms are increasingly simplifying the investment process for both new and seasoned investors. As fintech continues to advance, FintechZoom will play a larger role in streamlining investment management and decision-making, providing more precise, real-time insights and data to users.

Looking Ahead: The Future of Investment Technology

As technology evolves, so will the tools available to investors. Platforms like FintechZoom are likely to incorporate AI, machine learning, and other innovations to deliver more personalized investment strategies and actionable insights. These advancements will enhance the user experience, helping investors make smarter, more informed choices while staying ahead of market changes. In the future, FintechZoom will be a crucial part of the modern investor’s toolkit, especially when navigating the complexities of the S&P 500.

Summary

FintechZoom SP500 is a powerful platform designed to assist investors in navigating the complexities of the stock market, with a strong focus on the S&P 500 index. By offering real-time data, trend analysis, and predictive insights, it helps users make informed investment decisions. The platform enables diversification by providing insights into emerging sectors within the S&P 500, allowing investors to distribute their portfolios across various industries, reducing risks and enhancing potential returns. Additionally, FintechZoom SP500 offers educational resources like tutorials and webinars to help both novice and experienced investors understand market dynamics and build more informed strategies. Customization options such as personalized alerts and tailored investment suggestions further enhance the user experience.

Despite its many advantages, FintechZoom SP500 does come with some challenges, such as a learning curve for new users, although the platform provides comprehensive tutorials for support. While it offers greater flexibility and lower costs compared to traditional brokers, some investors may still prefer the personalized assistance provided by conventional firms. Looking ahead, FintechZoom SP500 continues to evolve, introducing new features that enhance its value for investors. The S&P 500, representing 500 of the largest U.S. companies, serves as a key investment vehicle for those seeking long-term growth and financial stability, making platforms like FintechZoom SP500 valuable tools for efficiently navigating this essential index.

FAQs About FintechZoom S&P 500

1. What is FintechZoom?

FintechZoom is an online platform that offers a comprehensive suite of tools and resources to help investors make informed decisions. It focuses on providing real-time data, trend analysis, and predictive insights, particularly for the S&P 500 index, as well as broader market trends. The platform is designed to be accessible for both novice and experienced investors, helping them track market performance and optimize their investment strategies.

2. How does FintechZoom assist with investing in the S&P 500?

FintechZoom offers a variety of tools that allow users to analyze market data, track trends, and evaluate the performance of S&P 500 companies. The platform provides insights into emerging sectors, helps implement diversification strategies, and offers predictive tools that help investors make data-driven decisions. It also gives users the option to customize their experience with alerts and investment suggestions tailored to individual goals and risk profiles.

3. Are there any risks or challenges when using FintechZoom?

While FintechZoom offers numerous advantages, there are some challenges. New users might face a learning curve in understanding the platform’s features, but the company provides helpful tutorials and customer support. Additionally, some investors may prefer the personalized service offered by traditional brokers, while FintechZoom is more focused on offering flexibility and lower costs.

4. What makes the S&P 500 an attractive investment?

The S&P 500 tracks the performance of 500 large-cap companies across various sectors and represents about 80% of the total U.S. stock market capitalization. It is a reliable barometer for the U.S. economy and provides investors with exposure to some of the most financially stable companies. Over time, it has shown strong, stable growth, making it an attractive option for long-term investors.

Don’t miss the latest updates and alerts visit: USA Tech Magazine!